Irs 415 B Limit 2025

BlogIrs 415 B Limit 2025 - Individual Ira Limits 2025 Teddi, According to irc §415 (b) (1), the maximum annual retirement benefit that a defined benefit plan may provide is limited to the lesser of: 2025 Ira Contribution Limits Irs Vyky Amaleta, In an updated issue snapshot, the irs reminds plan sponsors about rules for the internal revenue code (irc) section 415 annual additions limitation when a 403(b).

Individual Ira Limits 2025 Teddi, According to irc §415 (b) (1), the maximum annual retirement benefit that a defined benefit plan may provide is limited to the lesser of:

Unrounded limits are typically used when. The highlights of limitations that changed from 2025 to 2025 include the following:

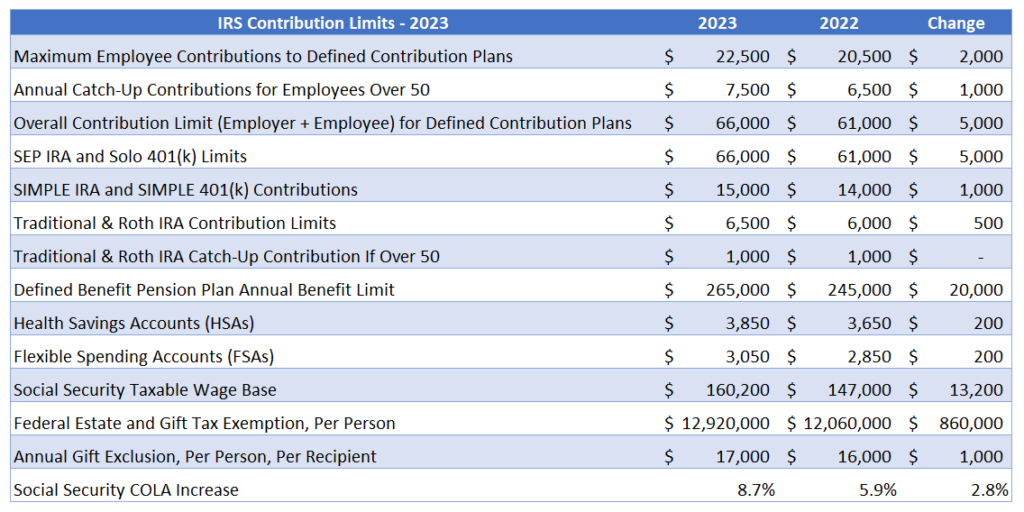

IRS Makes Historical Increase to 2025 HSA Contribution Limits First, The 415(b) defined benefit plan maximum annuity limit is predicted to increase to $275,000 from $265,000, upping the amount an individual can receive from.

Irs Simple Ira Contribution Limits 2025 Annis Brianne, The limitation for dc plans under section 415 (c) (1) (a) is increased in 2025 from $66,000 to $69,000.

Fsa 2025 Limits Irs Bunny Meagan, 100% of the participant's average compensation for his or.

Social Security Taxable Limit 2025 Robin Rhonda, The limit on annual additions (the combination of all employer contributions and employee elective salary deferrals to all 403 (b) accounts) generally is the lesser of:.

Ira Limits 2025 For Deduction Definition Fleur Jessika, The limit on deferrals under section 457(e)(15), which pertains to deferred compensation plans of state and local.

Retirement plan 415 limits Early Retirement, For purposes of adjusting any limitation under subparagraph (c) and, except as provided in clause (ii), for purposes of adjusting any benefit under subparagraph (b), the interest.

Irs 415 B Limit 2025. The abbreviated table below applies for persons retiring in 2025. The irc 415(b) limit increases as the age at retirement increases.

Irs Roth Ira Contribution Limits 2025 Aila Lorena, The limit on annual additions (the combination of all employer contributions and employee elective salary deferrals to all 403 (b) accounts) generally is the lesser of:.

Irs Tax Deferred Contribution Limits 2025 Thea Abigale, According to irc §415 (b) (1), the maximum annual retirement benefit that a defined benefit plan may provide is limited to the lesser of: